Can Real Estate Booms Hurt Small Firms? Evidence on Investment Substitution

SFI Research Paper No. 18-38

with Difei Ouyang

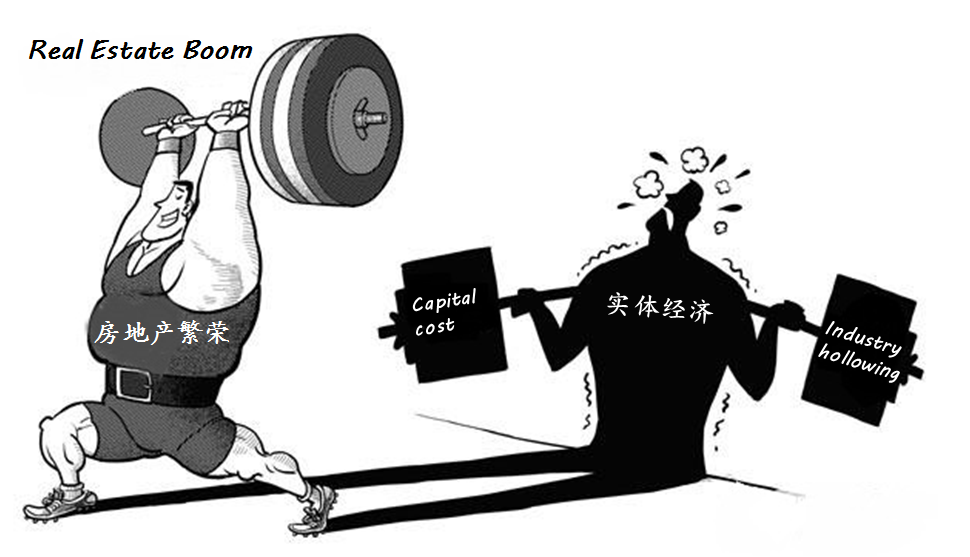

In geographically segmented credit markets, local real estate booms can deteriorate the funding conditions for small manufacturing firms and undermine their growth and competitiveness. Based on exogenous variations in the administrative land supply for residential housing across Chinese cities, we show that real estate price hikes caused by a restrictive land supply reduce bank credit to small firms, raise their borrowing costs, diminish their investment rate, compromise their output and productivity growth, and increase their exit rates. Such harmful effects are negligible among large firms due to weaker financial constraints. Using matched firm and product-level export data, we are able to discard local demand effects as an alternative explanation to the credit supply channel.

The paper is discussed on the policy website voxeu.org under the title Local capital scarcity and industrial decline caused by China’s real estate booms.

Its research results are also highlighted in the 2022 Summer double issue of The Economist.